Binance Coin (BNB) rises again and drives the cryptocurrency market crazy!

Last December 28 marked an impressive moment for the Binance Coin (BNB), as this cryptocurrency recorded a high of $336.4, reaching its highest level since April. This singular move diverted the overall trend of the cryptocurrency market, defying expectations by overcoming the initial resistance at USD 300 and closing the gap in market capitalization that had been set by Solana (SOL).

The Competition: BNB vs SOL

Prior to December 23, BNB held the coveted position of the third largest crypto, excluding stablecoins. However, SOL’s extraordinary gains, which increased by a staggering 50% in just seven days, upset this position.

Now, the question arises: will BNB be able to maintain its market capitalization to regain its privileged position, competing with Solana, two blockchains that offer fast speeds and cost-effective solutions?

BNB’s Value

The value of the BNB token is cemented by the reduced trading fees and exclusive services offered by the Binance platform. Despite initial concerns about potential market losses due to Binance founder Changpeng ‘CZ’ Zhao’s legal troubles, these concerns have not materialized so far. However, uncertainty persists until the pending legal issues are resolved.

Diversification of BNB’s Price Drivers

- Binance Smart Chain (BSC) Adoption and Utility: While activity on the BSC is an important factor, the growth and adoption of specific decentralized applications (DApps) and unique use cases can have a significant impact on the value of BNB. Increased participation in specific DApps that drive demand for the BNB token could directly influence its price.

- Institutional Adoption and Increased Usage: The attraction of institutional investors to BNB, along with increased usage in the financial and trading ecosystem, may be a key driver of its value increase. The integration of BNB into various financial services or its adoption as a payment method on more platforms may generate greater demand and thus an increase in its price.

- Binance Upgrades and Updates: Binance’s updates, upgrades and strategic announcements related to BNB, such as token burning programs, fee changes or new product or service launches, can significantly influence its value. These events often generate expectations in the crypto community, which affects the perception and future value of BNB.

- Cryptocurrency Market Dynamics: General crypto market movements also play a crucial role. Macroeconomic factors, regulatory news, investment behaviors, and the general perception of cryptocurrencies can affect the price of BNB regardless of its ecosystem.

What Triggers the BNB Increase?

The recent increase in BNB’s value may not be exclusively related to increased activity in the BSC chain. Unless this activity experiences substantial growth, regaining the third position in market capitalization could represent a significant challenge.

Road to the Maximum

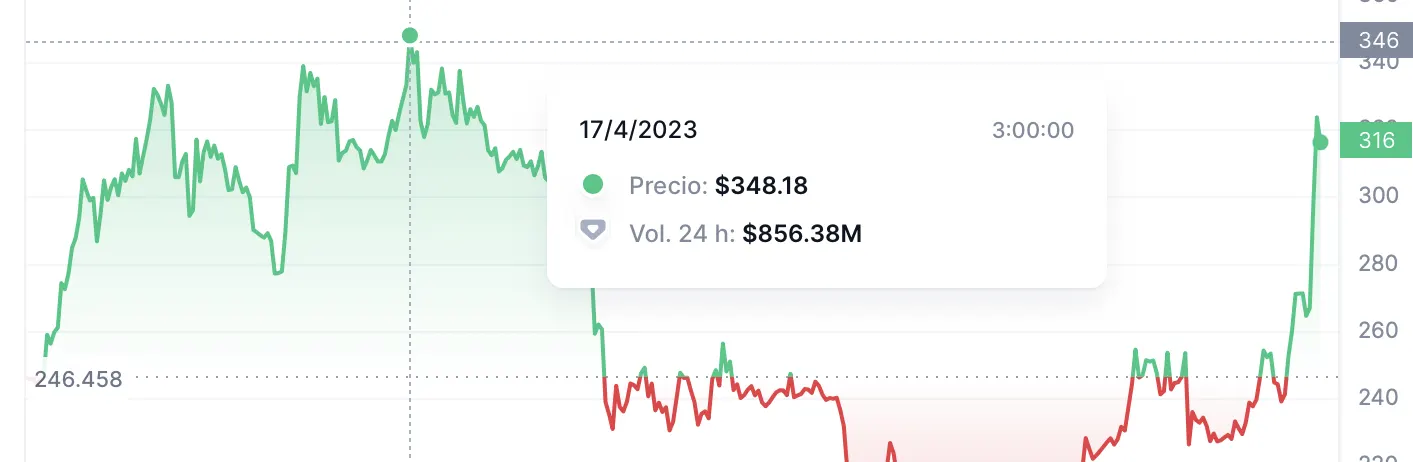

The current price of BNB ($317.96) suggests that it is likely to continue its uptrend in search of the April 2023 high of $348.18.

Understanding how the BNB price might move toward its April high involves a careful assessment of several factors. Considering recent market behavior and possible price direction, an outlook for a rise toward that peak could be based on the following:

- Current Uptrend: If the current uptrend continues, with a continued increase in demand and interest in BNB, there is a reasonable chance that the price will continue its climb towards the top.

- BSC Adoption and Utility: Increased activity and adoption of decentralized applications on the Binance Smart Chain could support an increase in demand for BNB. If the BSC chain continues to grow as a popular ecosystem for DApps, this could drive demand for BNB and thus its price.

- Key News and Developments: Major announcements by Binance or significant developments in technology, strategic partnerships or innovative implementations could trigger a sudden increase in demand and thus drive the price of BNB to higher levels.

- Market Confidence: Overall market sentiment towards BNB, influenced by investors’ perception of its long-term potential, can have a substantial impact. If news and information about BNB generates confidence and optimism, this could be a catalyst for a rally towards the April high.

That said, forecasting an exact rise to a peak involves a certain degree of uncertainty. The cryptocurrency market is highly volatile and subject to sudden changes due to various external and internal factors.

It is critical to closely follow news, industry developments and key indicators to assess the direction of the market. The combination of technical and fundamental analysis can provide a more informed perspective, but always with the caution that predictions in the cryptocurrency market carry an inherent degree of risk.

Share this article: